What Is Cryptocurrency market cap?

Cryptocurrency market cap is the total market capitalization of all cryptocurrencies in circulation is determined by multiplying the price of each cryptocurrency by its circulating supply.The total value of all cryptocurrencies in circulation is computed by multiplying the price of each cryptocurrency by its circulating supply. Market cap or capitalization for cryptocurrencies such as Bitcoin is the total worth of all coins created. Market cap is a rough indicator of how stable an asset is likely to be, as even Bitcoin, the cryptocurrency with the highest market cap, experiences volatility.

A cryptocurrency with a considerably higher market cap or capitalization is more likely to be a more stable investment than one with a much lower market capitalization. Digital currencies with smaller market caps, on the other hand, are more vulnerable to market whims and can see massive gains or severe losses. Currency data is refreshed every five minutes with the most recent market capitalization data, and new coins are routinely introduced to the market via initial coin offers.

What is the significance of market cap?

Market cap is an important indicator of a cryptocurrency’s value, allowing investors to compare its growth potential and security with other coins. As of September 25, 2023, the total market capitalization of cryptocurrencies stood at $1.09 trillion, with Bitcoin being the largest and Ethereum the second largest. Market capitalization has fluctuated over the years, reaching an all-time high of $3 trillion in November 2021. However, it is still much higher than in 2017, when it was just $200 billion.

The market cap of a cryptocurrency is determined by the current price multiplied by the circulating supply. Coinmarketcap is a popular website for tracking the market capitalization of cryptocurrencies and providing insight into the popularity of each currency. All prices are calculated based on the average volume of all prices from different exchanges. It is important to track the circulating supply of a cryptocurrency and not the total supply as it is only available on the market at the time.

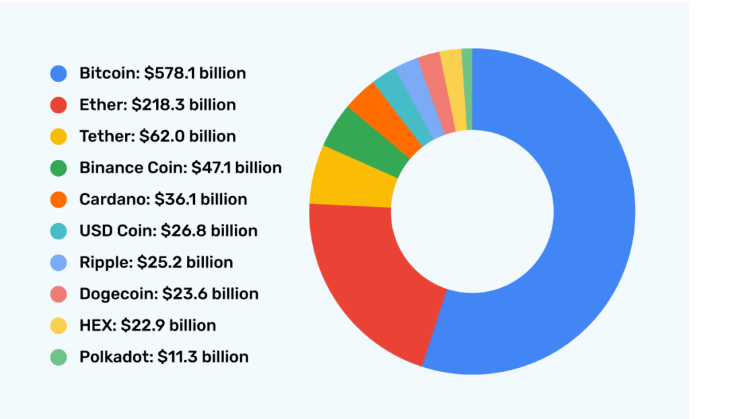

Market capitalization changes and fluctuates based on the price and circulating supply of the cryptocurrency and token, but the rankings are relatively stable. The top 10 cryptocurrencies by market capitalization in US dollars as of mid-July 2021 include Bitcoin, Ethereum, Tether, Bitcoin, Cardano, USD Coin, Ripple, Dogecoin, HEX and Polkadot.

Is market cap the greatest method to gauge a cryptocurrency’s popularity?

Market cap is an important indicator of a cryptocurrency’s relevance as it reflects its popularity over time. Large-cap cryptocurrencies are considered safe investments, with a market capitalization of over $10 billion. Mid-cap cryptocurrencies are more volatile but have greater growth potential, while small-cap cryptocurrencies are extremely volatile and considered very risky. Market capitalization does not provide much insight into the actual trading volume over the past few hours, so it is essential to check Coinmarketcap for 24-hour trading volume on different exchanges.

Cryptocurrency market cap is used to compare the relative sizes of different cryptocurrencies and track their growth or decline over time. However, the market is very volatile and market capitalization figures can change rapidly based on price fluctuations. Popular websites and cryptocurrency tracking platforms provide real-time data on cryptocurrency market capitalization, allowing investors and enthusiasts to track the market and performance of each electronic money.

Market cap help to reduce the risks of investing in cryptocurrencies:

Cryptocurrency investing involves a complex process that requires extensive research, understanding the technology behind the cryptocurrency, researching the project, and evaluating its potential use cases. Diversifying your portfolio across different cryptocurrencies can help spread risk and ensure a balanced investment strategy. Setting realistic goals and assessing risk tolerance is important, as cryptocurrency prices are known to be volatile. Secure wallets, such as hardware or software, are recommended for long-term storage, while online exchange wallets can be vulnerable to hacking.

Ensuring good security is essential, with two-factor authentication and unique passwords. Staying informed about cryptocurrency news and developments, avoiding emotional decisions, understanding market liquidity, and being wary of pump and dump schemes are also essential. Complying with tax regulations and seeking professional advice can help minimize potential losses. It’s important to start small and learn gradually, as cryptocurrency investments are highly volatile and can take years or even decades to reach their full potential.

Concern:

The cryptocurrency market cap is extremely volatile, with market capitalization suggesting trends as well as possible investment attractiveness or loss. When analyzing investments, investors should evaluate market trends, stability, and personal financial status. The market cap may fluctuate by billions of dollars in a single day, therefore investors must be mindful of the dangers associated with the volatile cryptocurrency market.